The 2005 Buffalo Nickel sits in a dangerous middle ground for collectors. It is modern, heavily produced, and still widely available. At the same time, a small number of genuine errors—most famously the Speared Bison—sell for hundreds or even thousands of dollars. That contrast fuels confusion and, too often, overpayment.

Issued as part of the Westward Journey Nickel Series by the United States Mint, the 2005 Buffalo Nickel revived the classic bison design to mark the bicentennial of the Lewis and Clark expedition. Nostalgia drew attention. Error discoveries locked in long-term interest. Opportunistic pricing followed.

Understanding where 2005 Buffalo Nickel value actually begins is the first defense against paying too much.

The Baseline Most Sellers Ignore

Before looking at errors or grades, it helps to anchor expectations. The majority of 2005 Buffalo Nickels are common.

Mintages were enormous:

- Philadelphia: ~448 million

- Denver: ~434 million

- San Francisco: proofs and special strikes

That volume keeps circulated examples at face value. No amount of description changes that reality.

Fair baseline prices look like this if you upload a photo to the coin evaluator:

- circulated P or D: $0.05–$0.10

- raw uncirculated MS60–MS63: $5–$10

- attractive but typical MS64–MS65 raw: $10–$15

Listings that jump straight to $50, $100, or more without certification or a confirmed error should trigger caution.

Why the Coin Attracts Overpricing

Two factors drive inflated listings.

First, the design. The bison reverse, created by Jamie Franki, echoes the iconic Buffalo Nickels of 1913–1938. Many buyers assume visual similarity equals rarity without cross-checking via the best coin app. It does not.

Second, the fame of the Speared Bison error. Genuine examples are scarce and valuable. That makes the name attractive to sellers applying it loosely—or incorrectly—to scratched, damaged, or altered coins.

Once a buyer connects “2005 Buffalo Nickel” with “$2,000 auction result,” restraint often disappears.

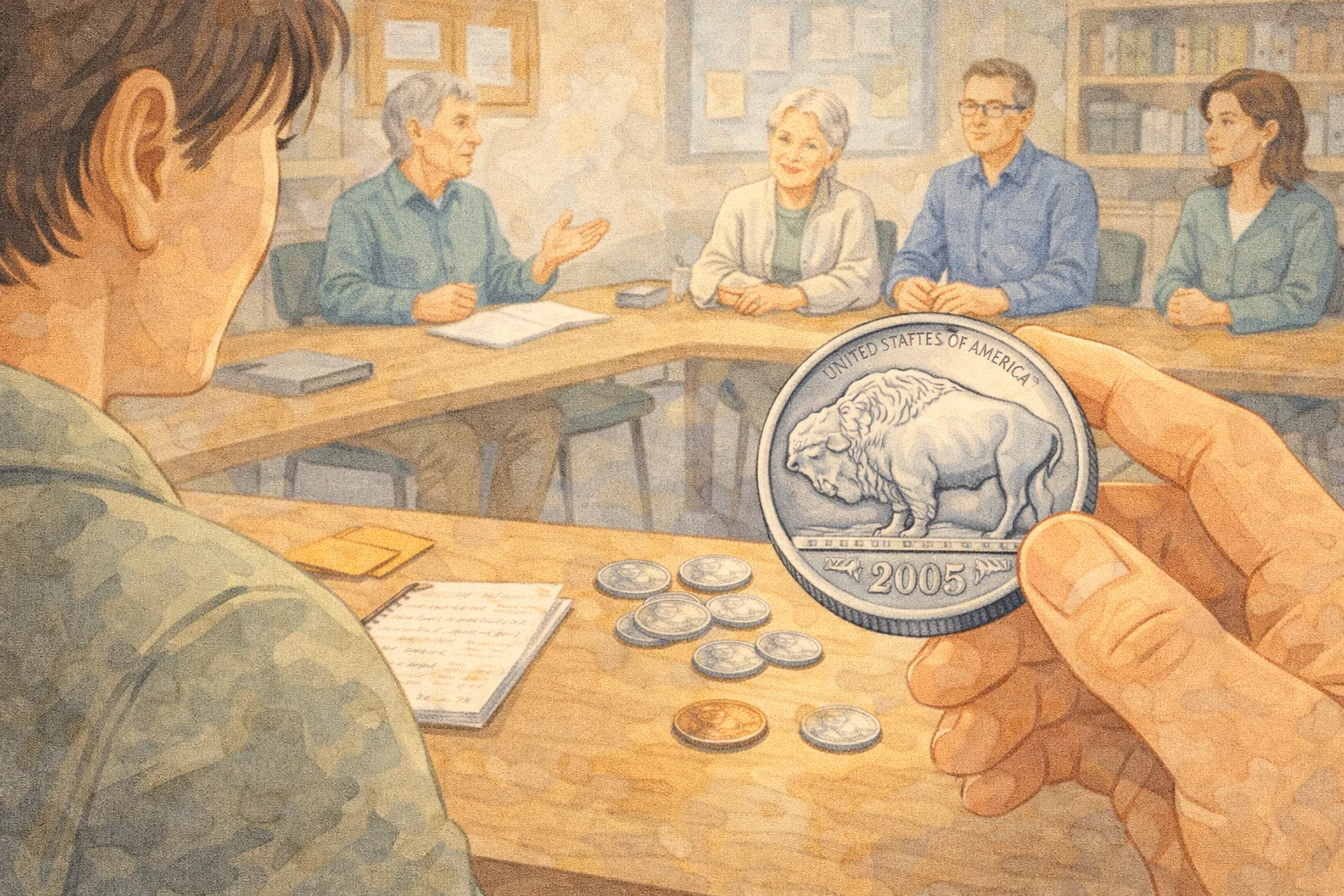

The Single Error That Justifies Big Money

Only one variety routinely supports four-figure prices: the 2005-D Speared Bison.

This error came from a damaged working die at the Denver Mint. A hard piece of metal gouged the die, leaving a straight channel. That channel transferred to coins as a raised, sharply defined line piercing the bison’s back.

Key traits of a real Speared Bison:

- the line is raised, not incuse

- it is straight and uniform

- it appears in the same location on confirmed examples

Anything else is not the Speared Bison.

Authentic pieces graded MS65 and above by Professional Coin Grading Service or Numismatic Guaranty Company trade from $500 to over $2,600 depending on grade.

That price range does not apply to raw coins with random scratches.

The Most Common Overpay Scenario

The typical trap looks like this:

- raw coin

- dramatic description

- no slab

- poor photos

- price set at $150–$300

At that level, risk outweighs upside. Genuine Speared Bison nickels rarely appear raw at bargain prices. When they do, they sell instantly.

Collectors who skip verification often discover the truth only after grading fees confirm the coin is ordinary—or damaged.

To screen quickly, many collectors rely on Coin ID Scanner. A photo-based check confirms date, mint, composition, and standard specs before time or money is spent chasing an error that cannot exist.

The 2005 Buffalo Nickel is not a bad coin to collect. It is a bad coin to guess on.

Grading Myths, Condition Hype, and Realistic Price Ceilings

After error claims, the next way buyers overpay is by trusting inflated grade descriptions. The 2005 Buffalo Nickel is especially vulnerable to this because strike quality is inconsistent across a very large mintage.

Why “Gem” Claims Fall Apart

Many sellers label raw coins as “MS67” or “super gem.” In practice, most 2005 Buffalo Nickels top out at MS63–MS65. Weak strikes on the bison’s shoulder and back are common, and contact marks from bulk handling are frequent.

Red flags to watch for:

- soft detail on the bison’s hump or leg

- muted luster that doesn’t cartwheel under light

- clustered ticks in open fields

Raw coins described as MS67 almost never grade that high. After fees, buyers often learn their “gem” is an MS63 worth a fraction of the price paid.

Where the Real Price Ceilings Sit

Without a major error, fair prices are capped tightly by grade:

| Condition | Typical Fair Price |

| Circulated | $0.05–$0.10 |

| MS63–MS64 (raw) | $5–$10 |

| MS65 (raw) | $10–$15 |

| MS65 (slabbed) | $25–$40 |

| MS67 (slabbed, D) | ~$175 |

Anything above these levels requires third-party certification. Slabs from Professional Coin Grading Service or Numismatic Guaranty Company are not optional at higher prices—they are the market.

Population Reports Matter

Population data explains why prices behave this way. High mintages don’t translate into high-grade survivors. MS67 examples exist, but they are thinly represented compared to the flood of MS63–MS65 coins.

Sellers who cannot cite population figures or recent sold results are usually anchoring prices to hope, not data.

Special Strikes and Proof Confusion

Another trap involves Special Strikes (SP) and proofs. San Francisco issues show stronger luster and cleaner surfaces, which can look impressive in photos. They are legitimate collectibles, but they are not errors and do not justify Speared Bison–level pricing.

Perfect SP70 coins can bring significant money due to scarcity, but average SP coins remain affordable. Confusing finish quality with rarity leads to overspending.

Quick Reality Checks Before Buying

Before committing funds, experienced collectors run a few fast checks:

- confirm the coin’s mint and specs

- compare sold listings, not asking prices

- check population counts at the claimed grade

- verify that the price aligns with certification

Many buyers use Coin ID Scanner to confirm year, mint mark, weight, and diameter from a quick photo. This step filters out misidentified coins and saves grading fees on pieces that cannot reach the advertised grade.

Seller Vetting, Variety Verification, and Buying Discipline

The final way collectors overpay for a 2005 Buffalo Nickel has little to do with the coin itself. It comes down to who is selling it and how the claim is presented. Discipline here saves more money than any single grading tip.

Vet the Seller Before the Coin

Reputable sellers behave predictably. Risky sellers leave patterns.

Proceed with confidence when a seller:

- provides sharp, well-lit photos from multiple angles

- shows close-ups of the bison’s back for error claims

- lists certification numbers for slabbed coins

- accepts returns

Be cautious when you see:

- single blurry images

- dramatic titles without diagnostics

- “estate find” language used as proof

- prices far above recent sold results

Counterfeit slabs appear occasionally in this niche. Fonts, holograms, and insert layouts often look close—but not exact. Always verify certification numbers directly with Professional Coin Grading Service or Numismatic Guaranty Company before paying premium prices.

Verifying Varieties the Right Way

Claims like “feeder finger,” “improper anneal,” or “die gouge” require evidence. Each has clear traits.

Use this checklist:

- Raised vs. incuse: real die errors are raised

- Consistency: placement should match known examples

- Parallel lines: feeder finger marks are evenly spaced

- Color vs. metal: annealing issues alter color, not weight

Random scratches, discoloration, or environmental damage do not qualify as mint errors.

For fast screening, many collectors rely on Coin ID Scanner. A quick photo confirms date, mint mark, composition, weight, and diameter, which helps rule out impossible claims before deeper inspection. It also prevents paying grading fees on coins that cannot meet the stated criteria.

Where Fair Deals Actually Come From

High-pressure listings rarely offer value. Fair pricing tends to appear in quieter places:

- certified inventories at major dealers

- established auction houses with sold archives

- roll hunting and box searches

- local coin clubs and trades

Bulk “error lots” marketed online often average $1–$2 per coin in real value once hype is removed. Paying more assumes knowledge that is rarely present.

A Practical Buying Framework

Collectors who avoid overpaying usually follow the same structure:

- decide the target (error vs. grade vs. finish)

- set a strict price ceiling based on sold data

- require certification above that ceiling

- walk away when evidence is weak

This approach removes emotion. It also prevents the most common regret: paying Speared Bison money for a normal nickel.

The 2005 Buffalo Nickel rewards knowledge, not urgency. One error justifies big money. A few grades support modest premiums. Everything else stays grounded by massive supply.

By anchoring prices to certification, verifying errors under magnification, and choosing sellers carefully, collectors keep costs realistic and enjoyment high. In a market filled with noise, restraint is the rarest skill—and the most profitable one.